- dezembro 18, 2023

- Posted by: Cleilton

- Category: Bookkeeping

It is the depreciable price that is systematically allocated to expense through the asset’s useful life. The balance within the Tools account will be reported on the company’s balance sheet beneath the asset heading property, plant and equipment. For instance, the straight-line technique spreads out the value of an asset over its life. The declining steadiness technique starts with a excessive rate and lowers it over time. Both want cautious thought in regards to the asset’s cost, worth at the finish, and the way a lot it’s used. The amortization calculation divides the price of the intangible asset by its acknowledged estimated useful life.

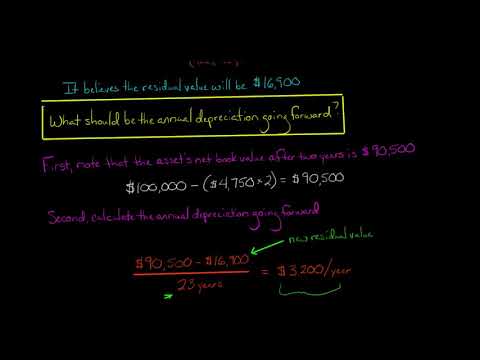

Depreciation plays a pivotal function in asset administration, representing the systematic allocation of a set asset’s cost over its helpful life. The rationale behind the conception of depreciation (and amortization for intangible assets) is tied to the matching precept of accrual accounting, where the expense is recorded in the same interval as when the corresponding benefit was derived. An asset’s useful life assumption refers to the estimated variety of years that the company’s management team expects it to be able to contribute optimistic economic value. The straight-line depreciation technique is considered one of the most simple and commonly used strategies for allocating the value of a tangible asset over its helpful life. This method evenly spreads the depreciation expense throughout each interval of the asset’s useful life, resulting in a constant reduction in the asset’s e-book worth.

The revised depreciation costs should start within the first month following last cost or when the asset is placed in service, whichever occurs first. The value incurred for any asset that doesn’t meet the factors described above or the capitalization threshold for similar property must be expensed in the period incurred. Repairs and maintenance costs incurred to maintain an asset at its current degree of operation aren’t capitalizable and should be charged to expense. The e-book worth of an asset is the amount of cost in its asset account less the amassed depreciation applicable to the asset. The book worth of an asset can additionally be known as the carrying worth of the asset.

Understanding Helpful Life And Its Position In Asset Depreciation

One of the main financial statements (along with the assertion of comprehensive income, steadiness sheet, assertion of cash flows, and statement of stockholders’ equity). The revenue statement can also be known as the revenue and loss assertion, P&L, assertion of earnings, and the assertion of operations. The income assertion reviews the revenues, gains, bills, losses, net income and other totals for the period of time shown within the heading of the assertion.

What Does Adjusting Journal Entry Imply In Accounting?

A longer estimated useful life leads to a smaller annual depreciation expense, as the asset’s cost is unfold over more years. Conversely, a shorter helpful life leads to the next annual depreciation expense. The idea estimated useful life of “useful life” is prime in accounting and finance, notably for companies managing tangible property. It represents an estimate of how long an asset is expected to provide financial advantages or contribute to a company’s operations. This estimation is a vital element in how companies account for their long-term investments. Understanding an asset’s helpful life helps in properly allocating its value over the interval it generates revenue or supports business actions.

- Course Of your expenses as property and routinely observe their worth with Debitoor invoicing software.

- These should be amassed in a subsidiary development account till completion of the project and capitalized in one or more subsidiary accounts under the suitable Bank premises asset.

- According to the Inner Income Service (IRS), the useful life of an asset is used to estimate the period over which depreciation of the asset might happen.

- The task of figuring out the estimated helpful life of an asset is handed over to the Managers or Accounting Committee (if any) or the Senior officers.

Mounted Asset Report Template

For instance, if a company purchases a machine for $200,000 with an estimated useful life of seven years, the annual depreciation expense could be $29,167 ($200,000 ÷ 7). The enterprise data this quantity as a depreciation expense in its income statement each year. The number of a depreciation technique and recovery period considerably influences a company’s monetary statements and overall tax position. Different depreciation strategies, such as straight-line or accelerated strategies, have distinct impacts on the distribution of an asset’s price over its useful life.

For advanced or unique property, participating professional appraisers or expert opinions can provide unbiased assessments, leveraging specialised data to determine a extra exact useful life estimate. Manufacturers’ specs and warranties supply preliminary steerage on an asset’s anticipated performance and sturdiness under normal operating conditions. These documents can present a baseline for an asset’s meant lifespan earlier than vital put on or technological points arise. The machine’s guide value at the finish of the fifth year can be $9,375 ($20,000 – $10,000 – $5,000 – $2,500 – $1,250 – $625). In this instance, extra significant depreciation quantities are expensed in the earlier years of the asset’s life.

72 Capitalization Thresholds Desk

This may contain updating depreciation schedules, re-evaluating tax implications, and modifying capital budgeting analyses.C) The IRS’s approval of a useful https://www.kelleysbookkeeping.com/ life change is decided by its evaluation of the company’s justification for the revision. Changes aren’t at all times granted; the IRS may deny adjustments if it believes they lack credible proof or don’t conform to tax laws. ConclusionUnderstanding the elements that affect useful life estimations is important for making knowledgeable business decisions and making certain correct monetary reporting. Companies should be vigilant about modifications in expertise, business tendencies, and other related factors that may require adjustments to their helpful life estimates.